Institute of Financial Operations (2012) stated that 56% of businesses experienced higher cost savings per invoice by implementing e-invoice systems than those that did not. In detail, a buyer can save 62% of the cost of processing an invoice and sellers can save 57% by adopting E-invoicing (GXS, 2013).

These statistics show a great benefit of E-invoicing for both buyers and suppliers: COST SAVING.

What more about e-invoicing? Of course, it has many other advantages that we will discover in this article. However, we will start with some basics of e-invoicing first.

What is the e-invoicing?

E-invoicing or electronic invoicing is a form of electronic billing. It is 100% digital format, which means an e-invoice is issued, received and processed electronically.

E-invoicing methods are used by trading partners to present and monitor transactional documents between one another and ensure the terms of their trading agreement are being met. Transactional documents include invoices, purchase orders, debit notes, credit notes, payment terms and instructions and remittance advices (GXS, n.d.).

Companies may use imaging software to capture data from PDF or paper invoices and input it into their invoicing system. Some companies have their own in house e-invoicing process. However many companies will hire a third party company to implement and support these e-invoicing processes and to archive the data that passes through them on their own servers (Scott Hesse, 2010).

Why is the e-invoicing necessary?

In fact, it can become very difficult for companies with many trading partners to keep track of all transactional documents. The department can become overwhelmed with paper invoices and other forms. This can lead to a host of problem including human error during data entry, lost invoices, late payments, invoice duplicates, and even double payments (Scott Pezza, 2010).

As a result, E-invoicing is a solution for the above problems because of its outstanding abilities:

· E-invoicing centralizes all transactional documents in one location on a web server

· E-invoicing allows vendors to submit invoices over the internet and have those invoices automatically routed for processing

· Invoice arrival and presentation is almost immediate

(The Institute of Financial Operations, 2012).

What are the benefits of e-invoicing?

For buyers

1. Saving cost

An electronic invoicing process can yield savings of 60–80 per cent, with a payback period of six to eighteen months (GXS Limited, 2013) because of the elimination of sorting, registering and manual data entry of paper invoices (GXS Limited, 2013).

Moreover, European commission also expects that £18 billion savings can be obtained from promoting e-invoicing (2012).

2. Increasing accuracy and accounts payable productivity

Electronic capture of invoices enables straight-through processing of critical business data into accounts payable systems without relying on error-prone, manual re-keying of data. As a result, the amount of re-work required due to invoice errors is reduced. Moreover, there is a smaller volume of supplier phone calls to accounts payable centers.

3. More trade discount opportunities

Electronic invoicing enables faster processing and approval of invoices, so you can take full advantage of timely payment discounts. There are several different models for early payments, ranging from buyer-managed invoice discounting programs, supplier receivables factoring programs, bank-led supply chain finance programs and multi-bank electronic marketplaces. Each of the different models from receivables factoring to supply chain finance appeals to different types of companies.

For suppliers

4. Fewer rejected invoices

E-invoicing enables straight-through processing directly from your account receivable system to your customer’s accounts payable application. E-invoicing eliminates the buyer’s need to manually re-key the data, reducing the potential for data entry errors. Thus, invoices are less likely to be rejected and customers can start processing them without delay.

5. Faster payment

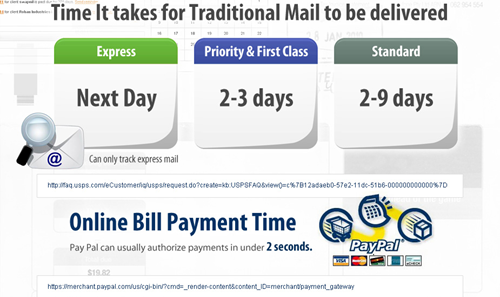

E-invoicing eliminates the delays that result from mailing, routing, sorting and re-keying paper documents. Customers can easily route your invoices for fast processing and approval because the data is immediately available electronically in their workflow systems. As a result, invoices can be paid on time, days sales outstanding can be reduced by four days or more and cash flow is improved.

6. Enhanced account reconciliation

Suppliers are challenged to reconcile the payments they receive from customers against the original invoices they submitted. Customers often consolidate a number of invoices and allow a single bank to transfer, so suppliers must call the buyer’s account payable department to understand the details behind funds received.

With E-invoicing, customers can send electronic remittance advice with the payment, providing a detailed accounting of reconciled invoices paid as well as debits, credits, and adjustments taken. Additionally, this helps in situations where customers claim deductions against an invoice due to shipment problems such as damaged or missing items.

Now, we already understand the basics of E-invoicing and its benefits for both buyers and suppliers. However, you are probably confused with its application to your stores. The following Q&A section will help you solve this problem and if you have other questions, leave us a comment and we will answer you as soon as possible.

Q&A

Question1: At what invoice volume does it make sense to consider e-invoicing?

Start seeing ROI if you process a minimum of 800 invoices per month.

Question 2: What are the biggest barriers to a successful e-invoicing project?

According to Paystream Advisors, Invoice and Workflow Automation, 2013:

- Lack of budge: 16%

- We do not think there will be an ROI: 15%

- Lack of understanding of current available solutions: 6%

- Lack of resources to manage automation: 18%

- Supplier resistance: 25%

- Current processes work: 20%

Question 3: What is the best way to measure ROI?

Key Metrics:

- Average cost per invoice

- Number of invoices processes per FTE

- Days Payable Outstanding

- Percentage of electronic invoices

- Percentage of overdue invoices

- Account payable liability balance

How do you think about these benefits of E-invoicing? Can they fulfill your expectation? What else do you want to know? Drop us a line in the comment box so we can do more to help you.